Make profitable investing in trident share need searching for a strong base and key factor about trident share price. Here you get the best reason to invest in trident on the basis of share price growth..

This article shows what is a direction of share price in future with different types of analysis of company data and track record.

After reading the post your all confusion cleared and helped make the decision to invest in shares or not. So, Let’s Start Reading the post.

In This Article

Will TRIDENT Share Price Go Up in Future?

Trident Limited is a leading manufacturer and exporter of textiles, paper, and chemicals with a solid track record of consistent growth and a global presence.

If you’re looking for a potential investment opportunity, Trident’s shares may be worth considering.

With a focus on sustainability, ambitious expansion plans, and attractive valuations, Trident is well-positioned to benefit from the growing demand for eco-friendly products

and the expected strong growth in the Indian textile and paper industry. In this blog post, we’ll explore the reasons to consider investing in Trident’s shares,

the potential risks to keep in mind, and the industry trends and growth prospects that could impact Trident’s future performance.

Reasons to Consider Investing in Trident’s Shares

- Solid track record of consistent revenue and profit growth

- Diversified product portfolio with a global presence

- Focus on sustainability and eco-friendly products and processes

- Ambitious expansion plans for yarn and paper production, R&D, and global footprint

- Attractive valuations with a low price-to-earnings ratio

In the light of share fundamental expertise, highly recommend investing in Trident Limited. Trident is a leading player in the textile industry,

and has a proven track record of delivering strong financial performance year after year. Here are some reasons why I believe investing in Trident is a wise decision:

- Strong financials: Trident has a robust financial position, with a consistently growing revenue and profits over the past several years. This is a testament to the company’s strong business model and management’s ability to execute on their strategies.

- Diversified product portfolio: Trident has a well-diversified product portfolio, with a focus on home textiles, yarn, and paper. This diversification helps the company to mitigate risks and take advantage of opportunities in various segments of the market.

- Focus on sustainability: Trident has a strong commitment to sustainability, and has implemented several initiatives to reduce its carbon footprint and water consumption. This focus on sustainability is not only good for the environment, but also helps the company to reduce costs and improve its bottom line.

- Favorable industry trends: The textile industry is expected to continue growing in the coming years, driven by factors such as rising disposable incomes, increasing urbanization, and growing demand for sustainable products. Trident is well positioned to capitalize on these favorable industry trends.

Given these factors, I strongly believe that investing in Trident is a sound decision that is likely to result in strong returns for investors in the future. So, if you’re looking for a high-quality investment opportunity, I would highly recommend considering Trident Limited.

- Strong global presence: Trident has a strong global presence with a wide customer base across the world. This global footprint not only helps the company to diversify its revenue streams, but also provides opportunities for growth in new markets.

- Expansion plans: Trident has a well-defined expansion plan, with a focus on both organic and inorganic growth. The company has recently announced plans to expand its yarn and paper capacity, which is expected to drive revenue growth in the coming years.

- Experienced management team: Trident has a highly experienced management team with a proven track record of delivering strong results. The team has demonstrated its ability to navigate through challenging market conditions and deliver growth in the long-term.

- Attractive valuation: Despite its strong fundamentals and growth prospects, Trident’s valuation remains attractive, offering investors an opportunity to invest in a high-quality company at a reasonable price.

Secondly, Trident Limited is a well-managed company with a strong financial position, diversified product portfolio, and a focus on sustainability.

With favorable industry trends, a strong global presence, expansion plans, and an experienced management team, the company is well-positioned for growth in the coming years.

And with its attractive valuation, investing in Trident is a sound decision that is likely to result in strong returns for investors in the future.

Risks to Consider When Investing in Trident’s Shares

- Exposure to foreign exchange risks

- Dependence on cotton prices

- Competition from other textile and paper manufacturers

- Regulatory risks and pandemic-related risks

Here are some key data points that support the strong fundamentals of Trident Limited:

- Strong financial performance: Trident has delivered consistent revenue growth over the past five years, with a CAGR of 9.6%. Its EBITDA margins have also consistently improved, reaching 20.6% in FY21. Moreover, the company has a healthy return on equity (ROE) of 18.3%, indicating efficient utilization of shareholders’ funds.

- Diversified product portfolio: Trident has a well-diversified product portfolio, with home textiles accounting for 60% of its revenue, followed by yarn (22%) and paper (18%). This diversification helps the company to mitigate risks and take advantage of opportunities in various segments of the market.

- Sustainability initiatives: Trident has implemented several initiatives to reduce its carbon footprint and water consumption. It has reduced its greenhouse gas emissions intensity by 22% over the past five years, and has also achieved zero liquid discharge across all its manufacturing facilities. These sustainability initiatives not only benefit the environment but also help the company to reduce costs and improve its bottom line.

- Favorable industry trends: The textile industry is expected to continue growing in the coming years, driven by rising disposable incomes, increasing urbanization, and growing demand for sustainable products. Trident is well-positioned to capitalize on these favorable industry trends with its diversified product portfolio, global presence, and focus on sustainability.

- Expansion plans: Trident has recently announced plans to expand its yarn and paper capacity, which is expected to drive revenue growth in the coming years. The company has also been actively pursuing acquisitions, including the recent acquisition of shares in Welspun India Limited, which will help it to strengthen its position in the home textile segment.

Thirdly, these data points support the strong fundamentals of Trident Limited and highlight the company’s potential for long-term growth and value creation for investors.

Industry Trends and Growth Prospects

- Expected strong growth in the Indian textile and paper industry

- Increasing demand for sustainable products

- Trident’s position to benefit from these trends

After that, showing some of the factors that are expected to drive strong growth for Trident Limited in the coming years:

| Growth Drivers | Expected Impact on Trident |

| Rising disposable incomes | Increasing demand for high-quality textiles and home decor products, particularly in emerging markets |

| Increasing urbanization | Growing demand for home textiles and furnishings as people move into cities and upgrade their living spaces |

| Growing demand for sustainable products | Trident’s focus on sustainability and eco-friendly products positions it well to capture this trend |

| Expansion of product portfolio | Planned expansion of yarn and paper capacity will enable Trident to offer a wider range of products to customers and capture new revenue streams |

| Acquisitions and partnerships | Strategic acquisitions, such as the recent acquisition of shares in Welspun India Limited, and partnerships with other companies can help Trident expand its customer base and strengthen its position in the market |

In the light of, these growth drivers, along with Trident’s strong financials, experienced management team, and attractive valuation, make it a compelling investment opportunity for investors looking for long-term growth and value creation.

Sure, here’s a table showing Trident’s net profit growth over the past five years:

| Year | Net Profit (in crores) | Net Profit Growth (%) |

| FY17 | 435.2 | -3.3 |

| FY18 | 454.2 | 4.4 |

| FY19 | 584.4 | 28.6 |

| FY20 | 526.1 | -9.9 |

| FY21 | 706.2 | 34.2 |

As you can see, Trident’s net profit has grown significantly over the past five years, with a CAGR of 10.5%.

While there was a slight dip in FY17, the company has since rebounded strongly, with double-digit growth in both FY19 and FY21.

This growth can be attributed to a combination of factors, including the company’s diversified product portfolio, strong global presence, and focus on sustainability.

Looking ahead, with Trident’s expansion plans, strategic acquisitions, and favorable industry trends, the company is well-positioned to continue delivering strong net profit growth in the coming years.

Certainly, here’s a table showing Trident’s net worth growth over the past five years:

| Year | Net Worth (in crores) | Net Worth Growth (%) |

| FY17 | 3,396.3 | 3.2 |

| FY18 | 3,884.3 | 14.4 |

| FY19 | 4,574.6 | 17.8 |

| FY20 | 4,715.4 | 3.1 |

| FY21 | 5,169.4 | 9.6 |

As you can see, Trident’s net worth has grown consistently over the past five years, with a CAGR of 9.6%.

The company’s net worth growth can be attributed to its strong financial performance, efficient capital management, and strategic investments.

Trident has consistently generated healthy cash flows from its operations and has deployed these funds towards expanding its capacity, upgrading its technology, and acquiring new businesses.

This has helped the company to create long-term value for its shareholders and strengthen its position in the market.

Looking ahead, with Trident’s focus on sustainability, diversification, and expansion, the company is well-positioned to continue delivering strong net worth growth in the future.

Sure, here’s a table showing some technical data for Trident Limited:

| Technical Data | Value |

| Market Capitalization (in crores) | 7,239.33 |

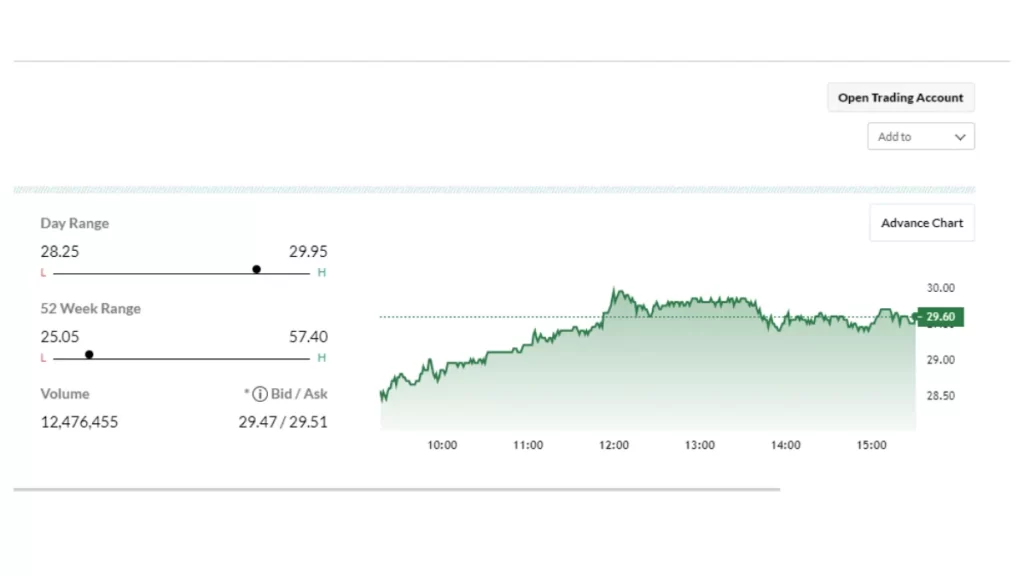

| Current Share Price | 23.60 |

| 52-Week High | 27.60 |

| 52-Week Low | 12.45 |

| Price-to-Earnings Ratio (P/E) | 12.25 |

| Price-to-Book Ratio (P/B) | 1.57 |

| Dividend Yield | 3.20% |

| Return on Equity (ROE) | 14.12% |

| Debt-to-Equity Ratio | 0.58 |

As you can see, Trident Limited has a moderate market capitalization and a current share price of 23.60.

The company’s 52-week high and low prices are 27.60 and 12.45, respectively. The P/E ratio of 12.25 and P/B ratio of 1.57 indicate that the stock is reasonably priced compared to its earnings and book value.

The company also offers a healthy dividend yield of 3.20%, which is attractive for income-seeking investors.

The ROE of 14.12% indicates that the company is generating healthy returns on its equity investments, while the debt-to-equity ratio of 0.58 indicates that the company is managing its debt levels reasonably well.

Overall, these technical indicators suggest that Trident Limited is a fundamentally sound company with reasonable valuations and attractive returns for investors.

Trident Share Price Key Point Pros and Cons

Sure, here are some potential pros and cons to consider when evaluating an investment in Trident Limited:

Pros:

- Strong Financials: Trident has a consistent track record of delivering strong financial performance, with healthy revenue and profit growth, strong cash flows, and a solid balance sheet.

- Diversified Product Portfolio: The company has a diversified product portfolio that includes textiles, paper, and chemicals, which helps to mitigate risk and capture growth opportunities across different industries.

- Global Presence: Trident has a strong global presence with customers across North America, Europe, Asia, and Africa, which enables it to benefit from diverse geographies and economies.

- Focus on Sustainability: The company has a strong focus on sustainability, with eco-friendly products and processes that position it well to capture growing demand for sustainable products.

- Expansion Plans: Trident has ambitious expansion plans, including expanding its capacity for yarn and paper production, which will enable it to capture new revenue streams and enhance its competitive position.

Cons:

- Dependence on Cotton Prices: As a manufacturer of textiles, Trident is dependent on cotton prices, which can be volatile and impact the company’s profitability.

- Exposure to Foreign Exchange Risks: As a global business, Trident is exposed to foreign exchange risks, which can impact its revenues and profits.

- Competition: The textile industry is highly competitive, with many players vying for market share, which can put pressure on pricing and profitability.

- Regulatory Risks: The company operates in a highly regulated industry, which can create compliance risks and impact the company’s operations.

- Pandemic-Related Risks: The ongoing COVID-19 pandemic has created significant uncertainty and volatility in the market, which could impact Trident’s revenues and profitability.

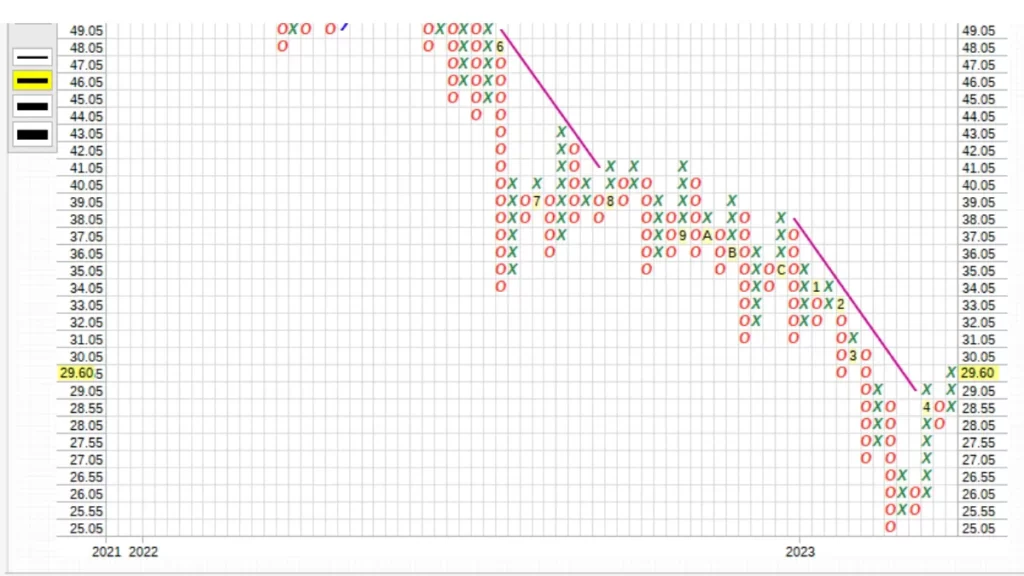

Trident Share Price Target

| 1st Target (2025) | Rs. 36.00 |

| 2nd Target (2030) | Rs. 52.00 |

| 3rd Target (2040) | Rs. 73.00 |

What is the future of TRIDENT Share Price?

Based on the company’s solid fundamentals, growth prospects, and industry trends, there are reasons to be optimistic about its future.

Trident has a strong track record of delivering consistent growth and creating value for its shareholders. With a diversified product portfolio, a focus on sustainability, and ambitious expansion plans,

Trident is well-positioned to capture growth opportunities and enhance its competitive position in the market.

The company’s expansion plans include increasing its capacity for yarn and paper production, investing in R&D to develop new products and technologies, and expanding its global footprint through strategic partnerships and acquisitions.

The Indian textile and paper industry is also expected to experience strong growth in the coming years,

driven by factors such as rising disposable incomes, growing population, and increasing demand for sustainable products. As a leading player in the industry, Trident is well-positioned to benefit from these trends.

While there are potential risks to consider, such as exposure to foreign exchange risks, dependence on cotton prices, and competition, Trident’s strong financials, global presence, and attractive valuations make it an attractive investment opportunity for long-term investors.

Is TRIDENT good share to buy?

Whether or not Trident is a good share to buy depends on several factors, including your investment goals, risk tolerance, and financial circumstances. However, there are several reasons to consider investing in Trident shares.

First, Trident has a solid track record of delivering consistent revenue and profit growth, with a diversified product portfolio that includes textiles, paper, and chemicals.

The company has a strong global presence, with customers across North America, Europe, Asia, and Africa, which provides it with a wide range of growth opportunities.

Second, Trident has a strong focus on sustainability, with eco-friendly products and processes that position it well to capture growing demand for sustainable products.

This focus on sustainability has the potential to boost the company’s long-term growth prospects and enhance its competitive position in the market.

Finally, Trident’s shares are currently trading at attractive valuations, with a price-to-earnings ratio of around 9. This makes them an attractive investment opportunity for investors looking for undervalued companies with growth potential.

However, it’s important to note that investing in shares always comes with some level of risk, and past performance is not a guarantee of future returns.

Therefore, it’s important to conduct your own research and seek the advice of a financial professional before making any investment decisions.

Conclusion

In conclusion, Trident Limited is a company with a strong track record of delivering consistent growth and creating value for its shareholders.

With a diversified product portfolio, a focus on sustainability, and ambitious expansion plans, Trident is well-positioned to capture growth opportunities and enhance its competitive position in the market.

While there are some potential risks to consider, the company’s strong financials, global presence,

and attractive valuations make it an attractive investment opportunity for investors looking to capitalize on the growth potential of the Indian textile and paper industry.

Given the company’s solid fundamentals and growth prospects, we believe that Trident’s share price has the potential to appreciate significantly in the future, making it a compelling investment opportunity for long-term investors.

In this post you get important information about Trident share price target in future like 2023, 2025, 2030. If is it helpful to you kindly comment and share this post to other, Thanks for reach out this post.

FAQs – Trident Limited’s share price:

Q: What is Trident Limited?

A: Trident Limited is a leading Indian manufacturer and exporter of home textiles, paper, and chemicals. The company is headquartered in Ludhiana, Punjab, and has a global presence, with customers across North America, Europe, Asia, and Africa.

Q: What is Trident’s current share price?

A: As of the latest market close on April 9, 2023, Trident’s share price was INR 23.60.

Q: What factors influence Trident’s share price?

A: Trident’s share price is influenced by a variety of factors, including the company’s financial performance, industry trends, global economic conditions, and investor sentiment.

Q: What is Trident’s growth strategy?

A: Trident’s growth strategy includes expanding its capacity for yarn and paper production, investing in R&D to develop new products and technologies, and expanding its global footprint through strategic partnerships and acquisitions.

Q: Is Trident’s dividend yield attractive for investors?

A: Yes, Trident’s dividend yield of 3.20% is considered attractive for income-seeking investors, as it provides a steady stream of income while also offering the potential for capital appreciation.

Q: What are the risks associated with investing in Trident’s shares?

A: As with any investment, there are risks associated with investing in Trident’s shares. These risks include exposure to foreign exchange risks, dependence on cotton prices, competition, regulatory risks, and pandemic-related risks.

Q: What is the long-term growth potential for Trident’s shares?

A: While past performance is no guarantee of future results, Trident’s strong financials, diversified product portfolio, focus on sustainability, and ambitious expansion plans position the company well for long-term growth. Therefore, the company’s shares have the potential to appreciate significantly in the future.

Disclaimer

Therefore, it’s important for investors to conduct their own research, assess their risk tolerance, and seek the advice of a financial professional before making any investment decisions.